New: National Gas Station Market Report (buyer demand, deal structures, diligence, financing, and metro guides).

Buy Gas Stations Nationwide

Quick answer: We represent buyers nationwide for on-market and off-market gas station opportunities, aligning deal structure, underwriting, and diligence so you can move fast and close clean. We match to your buy box and filter for real operators—not tire-kickers.

We help buyers find gas stations for sale and related opportunities (c-store for sale, convenience store for sale, truck stop for sale) through a curated, confidentiality-first process—on-market and off-market.

Institutional-grade sourcing for single sites to portfolios.

Tell us your criteria and we’ll match you with gas station and c-store opportunities—business-only, real estate included, leased fee, and operator leases.

Quick links: Buy · Buyer Intake · Sell · Off‑Market · How We Work · FAQ · Contact

Popular buyer searches

These pages are built around the most common ways buyers search for fuel and convenience assets:

- Gas station for sale

- Gas stations for sale

- Gas station business for sale

- Convenience store for sale

- C store for sale

- Gas station with car wash for sale

- Branded gas station for sale

- Gas station business only for sale

- Gas station for sale with real estate

- Truck stop for sale

- 1031 exchange gas station

- NNN net lease gas station

- More high-intent buyer searches

- Gas Station For Sale Seller Financing

- Gas Station Leasehold For Sale

- Gas Station Ground Lease

- Sale Leaseback Gas Station

- Gas Station For Sale With Diesel

- Gas Station For Sale Highway

- Gas Station For Sale Interstate

- Turnkey Gas Station For Sale

- Small Gas Station For Sale

- Gas Station For Sale With Convenience Store

- Gas Station Valuation

- How To Sell A Gas Station

- Top metros we cover

- Gas Station For Sale Dallas

- Gas Station For Sale Houston

- Gas Station For Sale Atlanta

- Gas Station For Sale Phoenix

- Gas Station For Sale Miami

- Gas Station For Sale Tampa

- Gas Station For Sale Orlando

- Gas Station For Sale Charlotte

- Gas Station For Sale Los Angeles

- Gas Station For Sale New York

What We Source

We help operators and investors locate gas stations, convenience stores, and truck-stop style assets across the U.S. We’ll match opportunities to your buy box and label the deal structure clearly so you can compare correctly.

- Nationwide matches for sale and lease (business-only or real estate included)

- Broker network outreach to uncover additional opportunities beyond major listing sites

- Business-only / leasehold (assignment or new lease)

- Real estate included (fee simple)

- Leased fee investments (passive ownership)

- Lease opportunities for operators

- Diesel / truck access when that’s your focus

Brands & Affiliates

Some buyers want a specific brand flag or supply relationship. Others are flexible as long as the location, terms, and store economics make sense. Either way, we can tailor your match list around a brand preference (or “open”).

- Major-branded and regional-brand opportunities (when available)

- Unbranded / open-supply scenarios where the deal allows flexibility

- Sites where branding can be evaluated during due diligence (subject to approvals)

Request Matched Opportunities Read FAQs

Confidential & Off‑Market Options

Some owners prefer privacy. When a deal is sensitive, we may release high-level details first and request NDA/qualification before sharing full financials and precise location.

Get Matched to Deals

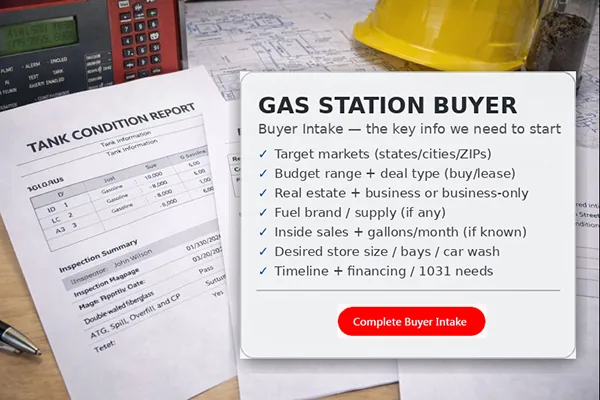

Fastest path: complete the buyer intake once. We’ll use it to filter listings and run broker outreach.

New here? Start with How We Work and the FAQ.

What to Include for Better Matches

- Budget range + timeline

- Target states/metros or ZIP focus

- Deal structure (RE included vs business-only vs leased fee)

- Must-haves (brand, diesel, car wash, QSR, etc.)

Buyer quick checklist

- Target geography: states/metros, radius, and must-have corridors

- Deal type: fee simple, leased fee, ground lease, or business-only

- Size & sales: inside sales preference, gallons range, canopy/MPD count

- Brand posture: branded, unbranded, or open

- Capital plan: all-cash, conventional, SBA, or hybrid

- Timeline: immediate, 3–6 months, or 6–12 months

Buyer quick checklist

- Target geography: states/metros, radius, and must-have corridors

- Deal type: fee simple, leased fee, ground lease, or business-only

- Size & sales: inside sales preference, gallons range, canopy/MPD count

- Brand posture: branded, unbranded, or open

- Timeline: immediate, 3–6 months, or 6–12 months

- Risk tolerance: environmental posture, lease term, and capex appetite

- Funding: proof of funds, lender relationship, or financing plan

If you’re new to fuel assets, start with the Gas Station Glossary and the due diligence overview.

Buyer quick checklist

- Target geography: states/metros, radius, and must-have corridors

- Deal type: fee simple, leased fee, ground lease, or business-only

- Size & sales: inside sales preference, gallons range, canopy/MPD count

- Brand posture: branded, unbranded, or open

- Timeline: immediate, 3–6 months, or 6–12 months

- Proof of funds: equity range + lending plan (if applicable)

Buyer quick checklist

- Target geography: states/metros, radius, and must-have corridors

- Deal type: fee simple, leased fee, ground lease, business-only

- Size & sales: inside sales preference, gallons range, canopy/MPD count

- Brand posture: branded, unbranded, or open

- Timeline: immediate, 3–6 months, 6–12 months

- Capital: proof of funds / down payment range and lender readiness

- Risk tolerance: environmental posture, lease term minimums, deferred maintenance

We can work on-market, off-market, or both—depending on your timing and confidentiality needs.

Buyer quick checklist

- Target geography: states/metros, radius, and must-have corridors

- Deal type: fee simple, leased fee, ground lease, business-only

- Size & sales: inside sales preference, gallons range, canopy/MPD count

- Brand posture: branded, unbranded, or open

- Timeline: immediate, 3–6 months, 6–12 months

- Capital plan: cash, lender-ready, or 1031 replacement

- Risk tolerance: environmental history / UST posture

Want definitions for the jargon? See the Gas Station Glossary.

What you get

- Curated matches based on your criteria (not mass emails)

- Clear pricing + deal structure notes

- Fast next steps when a deal fits

What we need

- Target market(s) and budget range

- Timeline and preferred deal type

- Best way to reach you

What happens next

- Quick call to confirm fit

- We send a short list of qualified opportunities

- We coordinate diligence and closing support

Confidential. No public blast unless you approve.

Deal Snapshots (Anonymized) — Buyer Side Only

We represent buyers directly and run a focused process to find workable opportunities (not just “for sale” ads), protect your leverage, and move fast when the numbers make sense. Here are a few anonymized examples of buyer-side work—kept intentionally general.

- Mid-Atlantic (Major Metro): Targeted acquisition — mapped the right trade areas, filtered out margin-compressed sites, and advanced only deals that underwrote with realistic fuel + inside sales assumptions.

- Southeast (High-Traffic Submarket): Underwriting + diligence triage — pressure-tested rent/lease terms, supply contracts, and inventory assumptions, then prioritized only the listings that could actually close on your timeline.

- West Coast (Dense Urban Area): Buyer qualification + controlled access — structured NDAs/POF early to unlock sensitive details, coordinated showings efficiently, and kept negotiations tight to avoid overpaying.

Want buyer-side examples closest to your market? Tell us your target area and price range and we’ll outline what we’re seeing right now.

Buyer-First Confidentiality

- Quiet search: We don’t blast your criteria publicly or shop your name around.

- Controlled disclosures: Sensitive seller details are handled responsibly and shared only as needed.

- Less wasted time: We screen for realistic sellers and executable terms before you go deep.

How It Works

- Quick intake: criteria, timeline, and capital/financing plan.

- Deal filtering: underwriting screen + red-flag checks (lease terms, margins, execution risk).

- Targeted sourcing: on-market + off-market outreach based on fit.

- Execution support: offers, diligence, lender/1031 coordination, and closing milestones.

Why Use a Broker (Not Just a Listing Site)

- Quality over noise: fewer listings, better fits, faster decisions.

- Off-market access: many viable opportunities never hit public sites.

- Execution control: structure + timeline discipline reduce “almost” deals that die late.

Quick Buyer FAQs

What’s the fastest way to start seeing deals?

Complete the buyer intake and we’ll begin sending curated matches and refining based on your feedback.

Do you send off-market opportunities too?

When available, yes. See Off‑Market for how NDA/qualification works.

Do you cover business-only and real estate deals?

Yes—business-only/leasehold, real estate included, leased fee, and operator leases. We label structure clearly.

Where can I get more answers?

See the full FAQ or contact us and we’ll point you in the right direction.

Related resources

Quick links to key pages visitors usually want next: