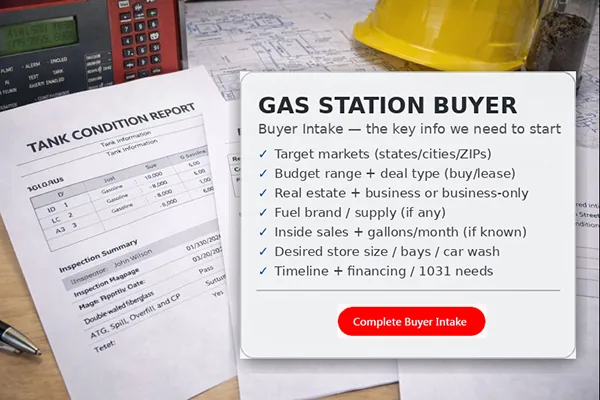

Buyer Intake: Request Curated Deals

Institutional-grade sourcing for single sites to portfolios.

Share your target markets, budget, deal structure, and must-haves. We’ll build a private shortlist and guide next steps (including NDA/qualification when a deal is confidential).

Quick links: Buy · Buyer Intake · Sell · Off‑Market · How We Work · FAQ · Contact

How It Works

This is the fastest way to get relevant deal flow. Instead of forwarding every listing we see, we filter by your budget, markets, deal structure (business-only vs real estate), and must-haves (brand, diesel, car wash, QSR, etc.).

We then build a short list that’s easy to act on—plus notes on structure, likely diligence items, and what to verify. For private deals, we may follow an off‑market NDA/qualification process before details are released.

- Nationwide on‑market search + broker outreach.

- Clear deal structure notes (RE included vs business-only, leased fee, lease).

- Investor-ready summaries focused on real numbers, not flyer hype.

- 1031 and lender-friendly organization available when needed.

After you submit, we’ll follow up with next steps and may ask a few quick questions to tighten matches. If you prefer, start on the Buy page first for an overview.

Tell Us What to Look For

Frequently Asked Questions (View full FAQ)

What should I include to get better matches?

Budget range, target geography, deal type (RE + business vs business-only), and your must-haves (fuel brand preference, diesel, car wash, QSR, etc.). The more specific you are, the fewer “wasted” listings.

Do you work with first-time buyers?

Yes. We can help you understand typical underwriting items (fuel margins, inside sales, rent coverage, inventory, environmental, and loan options).

Can you include off-market or confidential opportunities?

When available, yes. See the Off‑Market page for how we handle confidentiality and how introductions are made.

Do you verify gallons, inside sales, and expenses?

We request support during diligence (tax returns, POS reports, supplier statements, rent roll/leases, etc.). Early stage numbers are often broker‑provided estimates.

How do you estimate a ‘fair’ value?

We triangulate using deal comps, implied cap/EBITDA ranges, rent supportability, and market factors. For sellers, we provide a confidential value range (not a public blast).

Will you help me get financing?

Yes. See the Financing page for typical down payments, lender requirements, and what documents you’ll need.

Common questions

Do you have public listings I can browse?

We’re not a public listing directory. Many viable deals are confidential, so we match opportunities to criteria and share details after qualification.

What do you need to start?

Your target states/metros, price range, deal type (RE+business / business-only / ground lease / sale‑leaseback), and timeline. That’s enough to begin.

Will I see exact addresses?

Not at first. We share exact locations after qualification to protect sellers and reduce wasted outreach.

Do you help with financing or a 1031 exchange?

Yes. We coordinate with lenders and qualified intermediaries as part of the transaction plan when needed.

How fast can I review opportunities?

Typically within 24–72 hours after criteria are confirmed, depending on deal availability and the level of confidentiality required.

Related resources

Quick links to key pages visitors usually want next: